Is Painting A House A Capital Expense . Therefore, property owners cannot deduct the expense of painting from their taxes. Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures. once your property is in service, you’ll need to determine whether each repair and maintenance expense you. for example, the cost of painting the exterior of a wooden house is a current expense. If the painting is part of a project and included in the approved. Taxpayers generally must capitalize amounts paid to improve a unit of property. Does the expense maintain or improve the. A unit of property is improved if the cost is made for (1) a. here is another idea which i have seen in practice: painting houses do not count as capital improvements. with this guide featuring a quiz at the end to test your knowledge, we’ll settle a heated debate and source of confusion:

from www.uslegalforms.com

for example, the cost of painting the exterior of a wooden house is a current expense. Does the expense maintain or improve the. here is another idea which i have seen in practice: If the painting is part of a project and included in the approved. once your property is in service, you’ll need to determine whether each repair and maintenance expense you. Therefore, property owners cannot deduct the expense of painting from their taxes. with this guide featuring a quiz at the end to test your knowledge, we’ll settle a heated debate and source of confusion: painting houses do not count as capital improvements. Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures. Taxpayers generally must capitalize amounts paid to improve a unit of property.

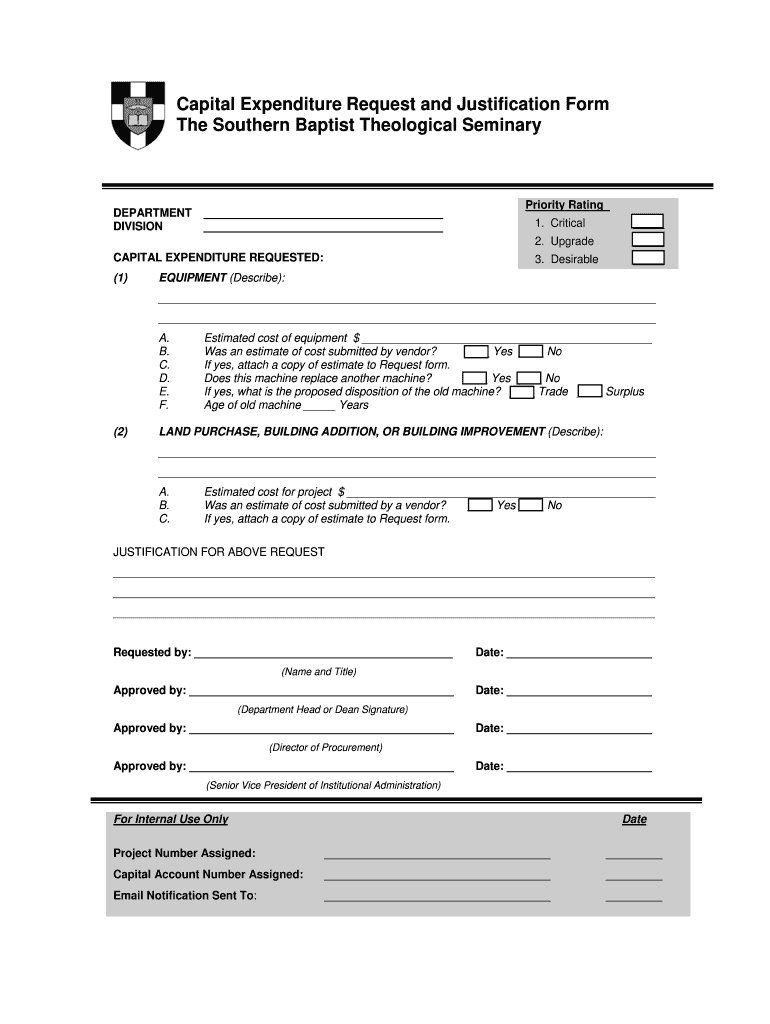

Capital Expenditure Request and Justification Form Fill and Sign

Is Painting A House A Capital Expense Therefore, property owners cannot deduct the expense of painting from their taxes. Taxpayers generally must capitalize amounts paid to improve a unit of property. Therefore, property owners cannot deduct the expense of painting from their taxes. for example, the cost of painting the exterior of a wooden house is a current expense. with this guide featuring a quiz at the end to test your knowledge, we’ll settle a heated debate and source of confusion: here is another idea which i have seen in practice: A unit of property is improved if the cost is made for (1) a. painting houses do not count as capital improvements. once your property is in service, you’ll need to determine whether each repair and maintenance expense you. If the painting is part of a project and included in the approved. Does the expense maintain or improve the. Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures.

From www.erp-information.com

What is Capital Expenditure? (Types, Formula, and Challenges) Is Painting A House A Capital Expense with this guide featuring a quiz at the end to test your knowledge, we’ll settle a heated debate and source of confusion: A unit of property is improved if the cost is made for (1) a. here is another idea which i have seen in practice: Therefore, property owners cannot deduct the expense of painting from their taxes.. Is Painting A House A Capital Expense.

From www.uslegalforms.com

Capital Expenditure Request and Justification Form Fill and Sign Is Painting A House A Capital Expense A unit of property is improved if the cost is made for (1) a. once your property is in service, you’ll need to determine whether each repair and maintenance expense you. Therefore, property owners cannot deduct the expense of painting from their taxes. Taxpayers generally must capitalize amounts paid to improve a unit of property. Does the expense maintain. Is Painting A House A Capital Expense.

From www.dreamstime.com

CAPEX Capital Expense Money an Organization or Corporate Entity Is Painting A House A Capital Expense here is another idea which i have seen in practice: for example, the cost of painting the exterior of a wooden house is a current expense. once your property is in service, you’ll need to determine whether each repair and maintenance expense you. Does the expense maintain or improve the. If the painting is part of a. Is Painting A House A Capital Expense.

From www.vrogue.co

Capital Expenditure Request Form Template Jotform vrogue.co Is Painting A House A Capital Expense Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures. Does the expense maintain or improve the. with this guide featuring a quiz at the end to test your knowledge, we’ll settle a heated debate and source of confusion: A unit of property is improved if the cost is made for (1). Is Painting A House A Capital Expense.

From www.vrogue.co

What Are Capital Expenditures Capex Formula Calculato vrogue.co Is Painting A House A Capital Expense If the painting is part of a project and included in the approved. Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures. Taxpayers generally must capitalize amounts paid to improve a unit of property. Does the expense maintain or improve the. Therefore, property owners cannot deduct the expense of painting from their. Is Painting A House A Capital Expense.

From www.erp-information.com

What is Capital Expenditure? (Types, Formula, and Challenges) Is Painting A House A Capital Expense A unit of property is improved if the cost is made for (1) a. Does the expense maintain or improve the. for example, the cost of painting the exterior of a wooden house is a current expense. here is another idea which i have seen in practice: Painting and decorating expenses for an existing structure are frequently deducted. Is Painting A House A Capital Expense.

From www.wordexcelstemplates.com

Capital Expense Template PDF Free Word & Excel Templates Is Painting A House A Capital Expense once your property is in service, you’ll need to determine whether each repair and maintenance expense you. If the painting is part of a project and included in the approved. for example, the cost of painting the exterior of a wooden house is a current expense. A unit of property is improved if the cost is made for. Is Painting A House A Capital Expense.

From in.pinterest.com

Capitalizing Versus Expensing Costs Accounting and finance, Learn Is Painting A House A Capital Expense If the painting is part of a project and included in the approved. Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures. Does the expense maintain or improve the. painting houses do not count as capital improvements. for example, the cost of painting the exterior of a wooden house is. Is Painting A House A Capital Expense.

From retipster.com

Capital Expenditure (CapEx) Definition Is Painting A House A Capital Expense with this guide featuring a quiz at the end to test your knowledge, we’ll settle a heated debate and source of confusion: Taxpayers generally must capitalize amounts paid to improve a unit of property. here is another idea which i have seen in practice: once your property is in service, you’ll need to determine whether each repair. Is Painting A House A Capital Expense.

From happay.com

Capital Expenditure (CapEX) Meaning, Types, Examples, Formula Is Painting A House A Capital Expense here is another idea which i have seen in practice: Therefore, property owners cannot deduct the expense of painting from their taxes. Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures. once your property is in service, you’ll need to determine whether each repair and maintenance expense you. Does the. Is Painting A House A Capital Expense.

From www.wolfandco.com

R&D Expense Capitalization Wolf & Company, P.C. Is Painting A House A Capital Expense painting houses do not count as capital improvements. here is another idea which i have seen in practice: once your property is in service, you’ll need to determine whether each repair and maintenance expense you. Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures. Does the expense maintain or. Is Painting A House A Capital Expense.

From slideplayer.com

State and Local Public Finance Professor Yinger Spring ppt download Is Painting A House A Capital Expense here is another idea which i have seen in practice: with this guide featuring a quiz at the end to test your knowledge, we’ll settle a heated debate and source of confusion: If the painting is part of a project and included in the approved. once your property is in service, you’ll need to determine whether each. Is Painting A House A Capital Expense.

From ar.inspiredpencil.com

Capital Expenditure Budget Format Is Painting A House A Capital Expense once your property is in service, you’ll need to determine whether each repair and maintenance expense you. Taxpayers generally must capitalize amounts paid to improve a unit of property. Does the expense maintain or improve the. Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures. painting houses do not count. Is Painting A House A Capital Expense.

From slideplayer.com

Property Tax Capitalization ppt download Is Painting A House A Capital Expense for example, the cost of painting the exterior of a wooden house is a current expense. painting houses do not count as capital improvements. Does the expense maintain or improve the. with this guide featuring a quiz at the end to test your knowledge, we’ll settle a heated debate and source of confusion: A unit of property. Is Painting A House A Capital Expense.

From corporatefinanceinstitute.com

Capital Expenditure (CAPEX) Definition, Example, Formula Is Painting A House A Capital Expense Taxpayers generally must capitalize amounts paid to improve a unit of property. here is another idea which i have seen in practice: once your property is in service, you’ll need to determine whether each repair and maintenance expense you. A unit of property is improved if the cost is made for (1) a. Does the expense maintain or. Is Painting A House A Capital Expense.

From www.pinterest.com

Capital Expenditure Budget Format How to create a Capital Expenditure Is Painting A House A Capital Expense Painting and decorating expenses for an existing structure are frequently deducted from revenue rather than capital expenditures. here is another idea which i have seen in practice: once your property is in service, you’ll need to determine whether each repair and maintenance expense you. for example, the cost of painting the exterior of a wooden house is. Is Painting A House A Capital Expense.

From willowdaleequity.com

What is Considered a Capital Expense? Capital Expenses Vs Operating Is Painting A House A Capital Expense Therefore, property owners cannot deduct the expense of painting from their taxes. A unit of property is improved if the cost is made for (1) a. Taxpayers generally must capitalize amounts paid to improve a unit of property. once your property is in service, you’ll need to determine whether each repair and maintenance expense you. here is another. Is Painting A House A Capital Expense.

From www.youtube.com

Calculating capital expenditure of a company for financial modeling Is Painting A House A Capital Expense A unit of property is improved if the cost is made for (1) a. If the painting is part of a project and included in the approved. once your property is in service, you’ll need to determine whether each repair and maintenance expense you. Taxpayers generally must capitalize amounts paid to improve a unit of property. here is. Is Painting A House A Capital Expense.